Posts

If you learn you to definitely a certain card doesn’t match your using habits or if your circumstances have altered, believe other available choices ahead of closure a charge card membership. Certain card issuers makes it possible to import your offered borrowing from the bank restrict to a different card stored reptile riches mega jackpot from the one financial. In case your credit has no annual fee, it may add up to leave the brand new cards open, however, play with another cards with a better award structure. Joining a credit card will be a great way to begin with building your credit rating, but isn’t a choice you need to take gently. Step one is always to perform a little research and find an excellent credit card you to best suits your circumstances. You can examine professionals, perks, interest levels and charge certainly cards using the listings, such as the one to above.

Reptile riches mega jackpot – IHG You to definitely Perks Premier Credit card

You’ll receive complimentary Gold position and you may a path to help you Diamond reputation via paying for the fresh card. The brand new Citi / AAdvantage World of business Professional Mastercard features a solid welcome render value $step one,200, centered on TPG’s October 2024 valuations. Cardholders appreciate automatic Silver position in the newest Hilton Honors and you may Marriott Bonvoy support apps, along with among the better couch availableness advantages of every team cards available.

Axos Bank $five hundred Bank account Render

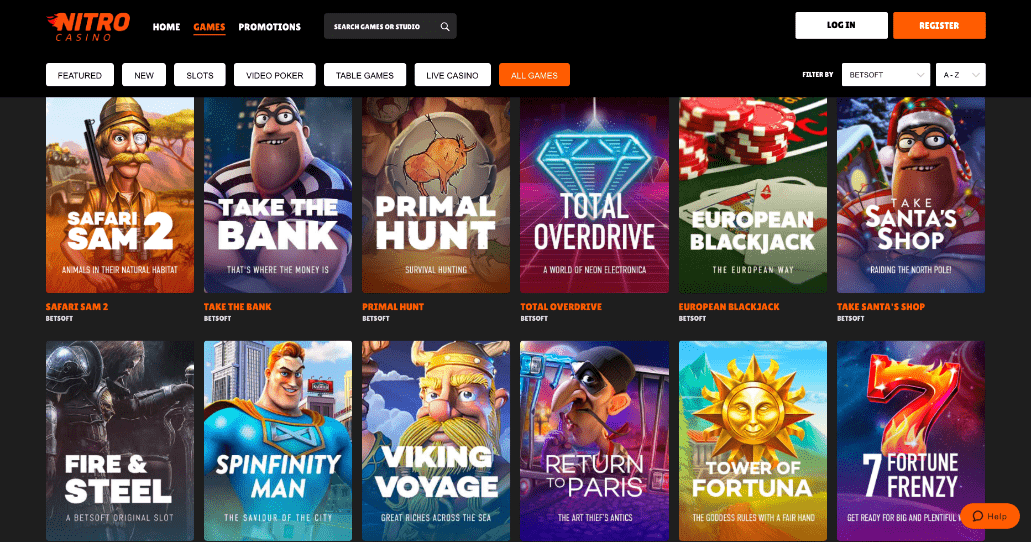

Try unlike titles and find out the mechanics which have a great $three hundred no deposit extra out of an on-line local casino. It’s a great treatment for find where you should purchase your money later. But really, know that the fresh prize they simply for the online game choices. Here’s a peek from the a number of the well-known classes to understand more about together with your no deposit campaigns. According to an average user’s shelling out for gasoline, food and you may departmental stores, we guess to secure a maximum of $623 inside cash return on the $15,900 in the paying on the Bluish Dollars Preferred credit from the first year.

Places in the SF Flames Borrowing Partnership try insured by the Western Show Insurance policies, the biggest merchant away from personal show insurance rates. Per SF Flames Credit Union put and you may certificate account is covered around $250,100. We extinguish monthly costs and you can people regrets you might have regarding the offering your lender the fresh footwear. $540 will be attained because of the being qualified for $240 inside advantages the first season along with the $3 hundred greeting…

Huntington National Bank: $100, $400 otherwise $step one,one hundred thousand extra

Here are the current SoFi promotions and you may incentives readily available for the newest banking people. The brand new Strategy X Organization introduced in early 2023 that have an amazing greeting incentive and you can a corresponding air-large investing demands. To start with only available due to a capital You to definitely Relationships Director, the fresh credit turned into in public available two months after which have a lower — but nevertheless epic— welcome give. For many who’lso are keen on making continuing attention unlike a bonus, Area Financial also offers an “Focus Checking Along with” account. It earns 0.02% APY providing you continue at least anything inside the new account. With no costs without minimum deposit conditions, this could be a beginning option for anyone seeking unlock a new account making a supplementary $2 hundred in the act.

$300 Totally free Processor chip Bonuses Overview

Tony began his NerdWallet community while the a writer and has worked his way-up in order to secretary delegating publisher and to guide assigning publisher. His writing could have been looked by La Minutes, MarketWatch, Mashable, Nasdaq.com, Us Now and you may VentureBeat. The fresh Joined Pub Infinite Cards is the greatest cards for United sofa availableness — club nothing. If you are a faithful Joined flyer whom uses a serious number of money to your journey annually, so it card could make a good introduction on the wallet. The fresh Issues GUYEven if not stay at Hilton characteristics seem to, it credit is definitely worth considering.

Whenever fund are designed offered very early, they will be mirrored on your account’s readily available balance. 4TD Done Checking Monthly Repair Percentage waived if the Number 1 membership manager try 17 as a result of 23 yrs old. Up on the key account proprietor’s 24th birthday celebration the brand new account might possibly be at the mercy of the newest Month-to-month Repair Commission until account requirements you to waive the newest Monthly Restoration Commission try satisfied. Just remember that , there is certainly usually no make sure just how long a great invited offer can last. When you have found one to you like, i recommend trying to get the new credit As quickly as possible. They obtained 4.2 from 5 superstars within the Bankrate’s report on the offerings.

Once you’ve finished the initial seasons from card subscription, the real difference inside the well worth among them notes try better, nevertheless Well-known card nevertheless wins. Actually with no advantageous asset of their greeting extra, typically the most popular card also offers $323 inside annual really worth typically, because the Everyday cards offers just $308 — a positive change from $15. The newest cards do include a steep $525 annual commission, but when you can also enjoy the pros you can of course emerge in the future. The main cheer of your cards ‘s the Joined Club settee accessibility, which if you were to purchase right from United, try $550 to $650 (rates hinges on the quantity of Joined elite group position). These types of cards are available having of use advantages to have frequent United flyers, such zero foreign purchase fees, totally free searched bags, and you will access to much more honor chairs on the Joined when scheduling aircraft with kilometers.